As the world emerges from the COVID-19 pandemic, the focus has shifted to the opportunities presented by the post-pandemic economic recovery particularly in Asia led by China. This may create a fertile ground for consumer funds seeking to take advantage of the region’s growth potential.

In this article, we explore the five potential reasons behind Asia’s consumer sector landscape, including China’s resurgence in consumer spending, manageable inflation rates, government prioritization of consumption recovery, the prospect of higher liquidity in the market, and the fact that Asia is still trading at a discount compared to developed markets. We also delve into the nature of consumer funds and how they can potentially help capture these opportunities.

Exploring the Landscape of Asia/China’s Consumer Sector:

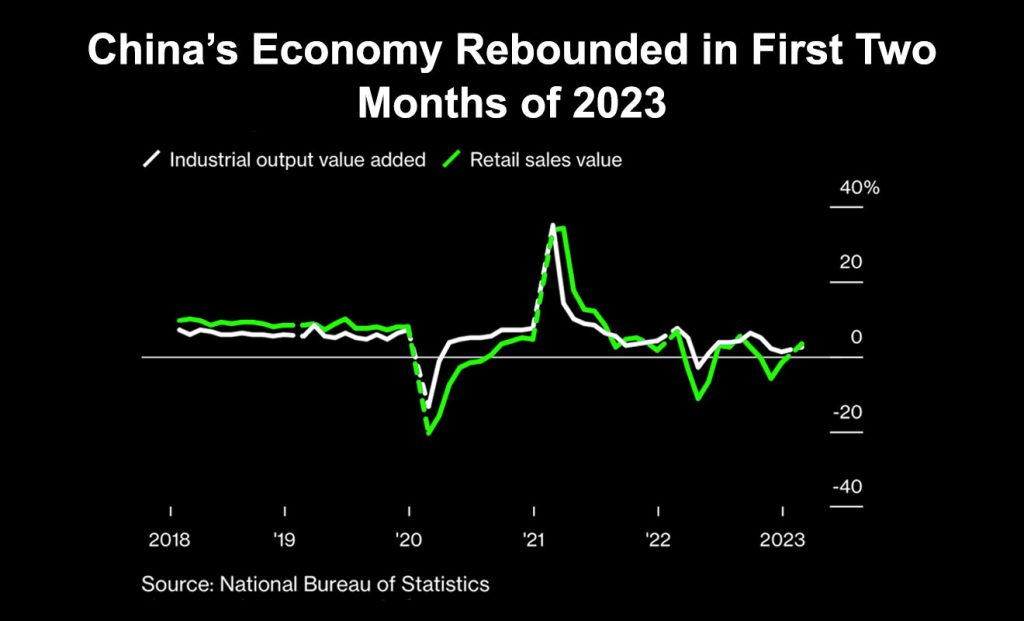

1. China’s Market Emerges from Pandemic Slump, As Citizens Eagerly Spend Their Savings

The reopening of China’s economy has fueled a rally in the country’s consumer sectors. The high savings rate among Chinese households due to the pandemic-induced depression of domestic demand is now fueling a consumption boom[1] . Retail sales rose 3.5% in January and February compared to the same period last year[2]. while national and online retail sales have also seen an uptick during the Chinese New Year, with an increase in the number of domestic tourists. These indicators signal a pickup in consumption demand as China reopens.

2. China Government Prioritizes Consumption Recovery

The Chinese government has prioritized the recovery and expansion of consumption, signaling their commitment to stimulating the economy and bolstering job creation. Premier Li Keqiang emphasized the importance of maintaining economic stability and bolstering consumption in his address to the National People’s Congress. He outlined his aim to generate approximately 12 million urban jobs this year, a notable increase from the previous year’s target of at least 11 million[3].

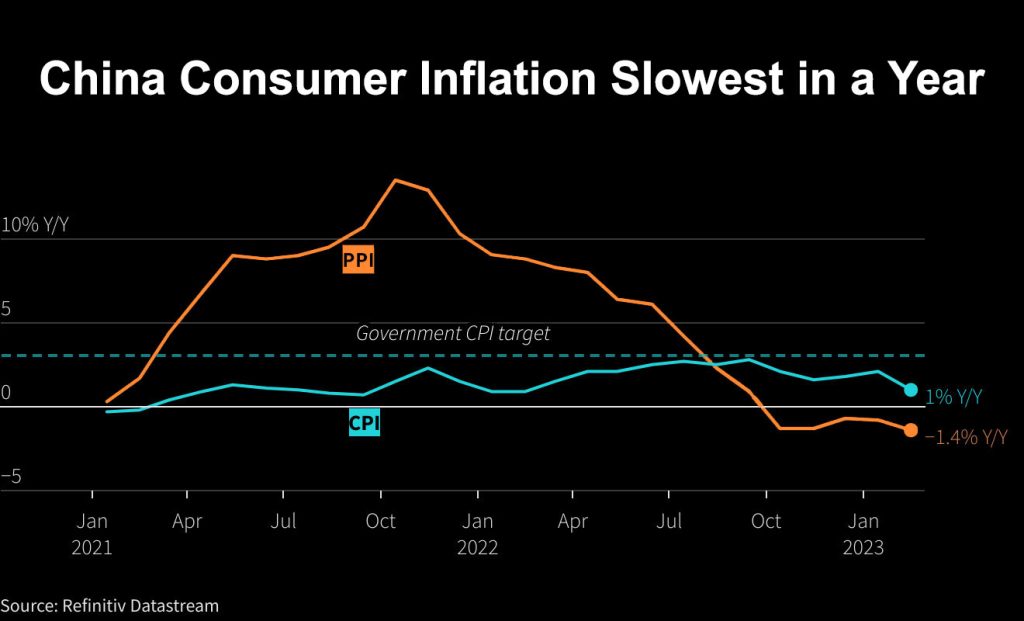

3: Manageable Inflation Rates in China

China’s consumer inflation rate hit a one-year low in February, increasing by 1.0% from the previous year, according to the National Bureau of Statistics (NBS)[4] . This suggests that price pressure may not be an obstacle to the government’s support for economic recovery from COVID-19 disruption. According to Wen Bin, the Chief Economist of Minsheng Bank, as the measures for epidemic prevention and control evolve, domestic demand is recovering. He believes that CPI and inflation will remain at a moderate level throughout the year[5].

4: Prospect of Higher Liquidity in China Market

Chinese central bank officials have pledged to adjust monetary policy in a timely and appropriate manner to bolster the country’s emerging economic recovery from the pandemic-induced slump. Top bank officials have highlighted the effectiveness of cutting banks’ reserve requirements in releasing long-term liquidity to support the economy[6] creating a potential favorable investment environment for those seeking to invest in the region’s emerging markets.

5: Asia’s Markets Still Undervalued Compared to Developed Counterparts

As of February 2023, the MSCI ASIA ex Japan index has a lower forward price-to-earnings ratio (P/E) of 12.7, compared to the MSCI USA index’s forward P/E of 17.99[7]. This suggests that the market in Asia (excluding Japan) is currently trading at a lower valuation compared to the US market. This may be an opportunity for investors seeking to capture the growth potential of the Asian market.

Introduction to Consumer Funds

Consumer funds are investment vehicles that specifically focus on companies that produce goods and services for everyday consumers. These funds invest in a broad range of industries such as retail, healthcare, food and beverage, and entertainment. The nature of consumer funds is such that they may provide exposure to companies that are likely to benefit from changing consumer trends and preferences.

If you would like to understand more about consumer funds segment and its opportunities, you may contact your dedicated financial advisor or leave your contact details at contact us form. Our representative will contact you shortly.

[1] Data from HSBC Global Research; [2] Data from Bloomberg; [3] Data from Reuters; [4] Data from reuters; [5] Data from Yahoo News; [6] Data from reuters; [7] Data from MSCI Index

#Disclaimer and Notes

Investment involves risk and past performance is not indicative of future performance. The content of this article is for reference only, and OnePlatform Asset Management Limited shall not be liable for any loss or damage caused by any person’s use or misuse of any information or content, or reliance on it.

Fund products and portfolio management services are distributed and/or rendered by OnePlatform Asset Management Limited (a licensed corporation with SFC CE No. AFQ784).

You May Be Interested In

OnePlatform Asset Management | 06 May 2024

Exploring the Potential of U.S. Equity Funds: Analyzing Factors Driving the U.S. Stock Market

OnePlatform Asset Management | 05 Mar 2024

Exploring the Beenfits of Investment-Grade Bond Funds in the Current Market Environment