Since 2024, the US stock market has continued its excellent performance from last year, with the S&P 500 index surpassing the 5,000-point milestone and reaching a historic high. With robust expansion in US economic data, it has increased investors’ confidence in the market ability to experience a soft landing. However, investors may have differing opinions on the market movement. In this article, we are going to discuss three major factors and assess the prospects of the U.S. stock market.

Understanding U.S. Equity Funds:

U.S. Equity Funds are investment vehicles that focus on investing in equities of US-based companies across various sectors and industries. It aims to provide investors with exposure to the U.S. stock market and the potential for long-term capital appreciation.

Top 3 Reasons to Consider U.S. Equity Funds:

1. Robust Economic Data: Although the U.S. first-quarter GDP growth was lower than expected, the performance of the U.S. economy remains strong. When compared to the other developed countries, the U.S. still exhibits a high level of momentum. The first quarter saw the average monthly additions of 276,000 jobs, while the unemployment rate remained at 3.8%, indicating a robust job market.[1] As of April 20, 2024, initial claims for unemployment benefits unexpectedly declined, indicating a tight labor market. Given the tight labor market, wages continue to rise, and contribute to economic growth through increased consumer spending. While the monetary policy is expected to shift in the second half of the year, it is important to note that despite the Federal Reserve lowering its rate-cut forecasts for 2025, committee members continue to maintain a somewhat dovish stance.

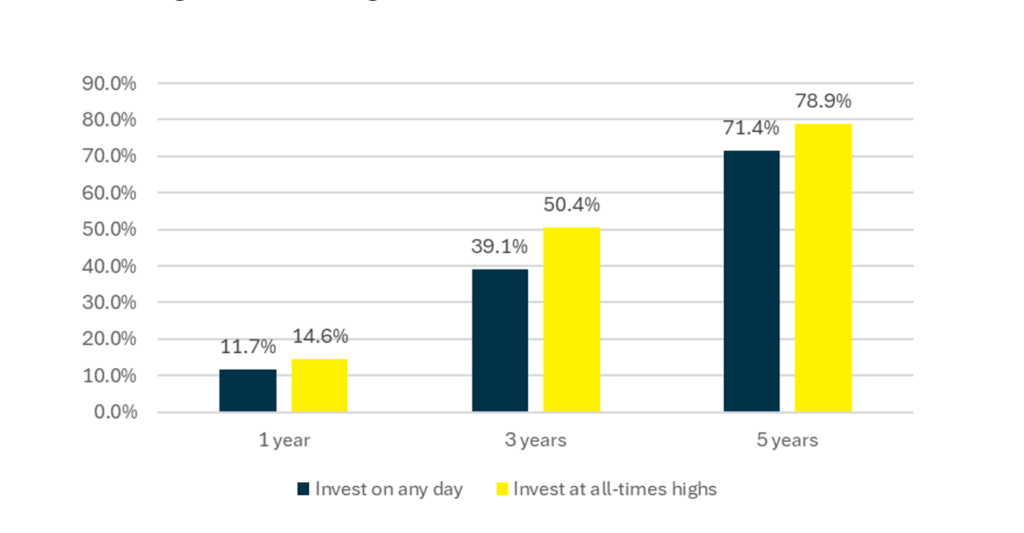

2. Expected Stable Earnings Growth: Following the optimism surrounding the artificial intelligence (AI) boom among investors in 2023, which led to a limited market rally driven by large-cap tech stocks, earnings growth is expected to expand to other constituent stocks of the market. Looking back at history, market is expecting the U.S. interest rate hiking cycle may reach its end, and interest rates tend to peak, which typically benefits stocks with higher valuations. Considering that corporate earnings are projected to continue stable growth in the coming years, and the Federal Reserve may potentially begin cutting rates within the year, the outlook for the stock market this year remains positive. Historical data indicates that investing in U.S. stocks at historical highs does not necessarily provide a clear advantage or disadvantage compared to other times.[2] Therefore, predicting future stock performance solely based on market levels is not feasible and underscores the importance of long-term investments. Long-term investments can withstand the impact of short-term market volatility and have the potential to achieve sustained investment returns.

Figure 1 – Average cumulative S&P 500 total returns

The data covers the period from January 1, 1988, to August 27, 2020.

3. Funds as a Tool for Diversification: The current year presents several uncertainties, including upcoming elections in various countries and geopolitical tensions both domestically in the United States and internationally. These factors introduce political risks, contributing to fluctuations in the stock market. Analyzing individual stocks in such a volatile environment requires significant time and effort. The U.S. stock market, being one of the largest and most active globally, offers industry diversity and innovation. By investing in U.S. equity funds, investors can achieve portfolio diversification and mitigate risk, as the performance of different industries and companies typically remains independent of each other.

Overall, the positive performance of the stock market is not expected to continue uninterrupted. However, from a long-term perspective, the steady economic data in the United States and the expected stable earnings growth still provide confidence to investors. It is difficult to accurately predict the timing of interest rate shifts based on recent data, and coupled with various uncertainties this year, the stock market experiences sustained volatility. Investing in U.S. stock funds can help mitigate the impact of short-term market fluctuations and provide investors with opportunities for long-term capital appreciation.

If you would like to understand this asset class and explore potential investment opportunities to diversify your portfolio, please talk to your financial advisor at OnePlatform Asset Management today.

#Disclaimer and Notes

Investment involves risk. Investors should carefully consider whether any investment products or services mentioned herein are appropriate for investors in view of their investment experience, objectives, financial resources and circumstances. The information is for general information and reference only and does not constitute nor is it intended to be construed as any professional advice, offer, solicitation or recommendation to deal in any of the securities or investments. OnePlatform Asset Management Limited shall not be liable for any loss or damage caused by any person’s use or misuse of any information or content, or reliance on it. Please consider to seek professional advice before making any investment decision if needed.

Fund products and portfolio management services are distributed and/or rendered by OnePlatform Asset Management Limited (a licensed corporation with SFC CE No. AFQ784).

[1] 美第一季度經濟增長放緩至1.6% 低於預期, Epochtimes, 26 Apr, 2024, https://hk.epochtimes.com/news/2024-04-26/46523821

[2] 聚焦台美潛力股 富邦投信:三多策略配置為今年首選, 經濟日報, 29 Apr, 2024, https://money.udn.com/money/story/5618/7930634?from=edn_related_storybottom

You May Be Interested In

OnePlatform Asset Management | 05 Mar 2024

Exploring the Beenfits of Investment-Grade Bond Funds in the Current Market Environment