Thus far Japan is one of the best-performing stock markets in 2023. The Nikkei 225 index has surged more than 30% earlier this year, surpassing 33,000 points for the first time since 1990.1 Warren Buffett’s Berkshire Hathaway (BRKA) has added to its holdings in Japan’s five largest trading houses, resulting in an average ownership interest of 8.5%. This move has drawn attention to Japan’s improving economy and corporate governance. Japan retail sales marked the 17th consecutive month of growth, backed by Japan’s economy and tourism boom after re-opening.

This article delves into the three key reasons why some investors are considering Japanese stocks and their related funds.

1. The favorable alternative for hedging geopolitical risk

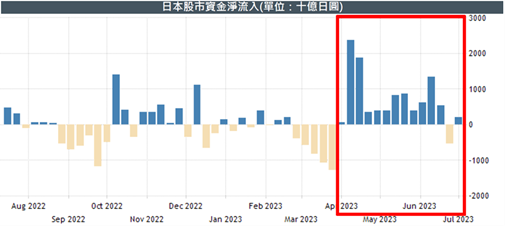

As China’s economic recovery falls short of expectations, concerns about a potential recession in the United States, and increasing global geopolitical tensions, Japanese equities have become the favored Asian market for investors seeking alternative options. Moreover, its low-interest rate environment is seen as a strong driver of the Japanese stock market. As of June 2023, foreign investors have been net buyers in the Japanese stock market for 11 consecutive weeks, a phenomenon that has not been seen since March 2013. Japanese equities have delivered impressive performance in 2023, outperforming both Asian and global markets.

Figure 1 – Foreigners’ Net Inflow in the Japanese Stock Market for 11 Consecutive Weeks

Figure 2 – Japan Outperformed Asia and Global markets so far this year

2. Corporate governance creates investment opportunities

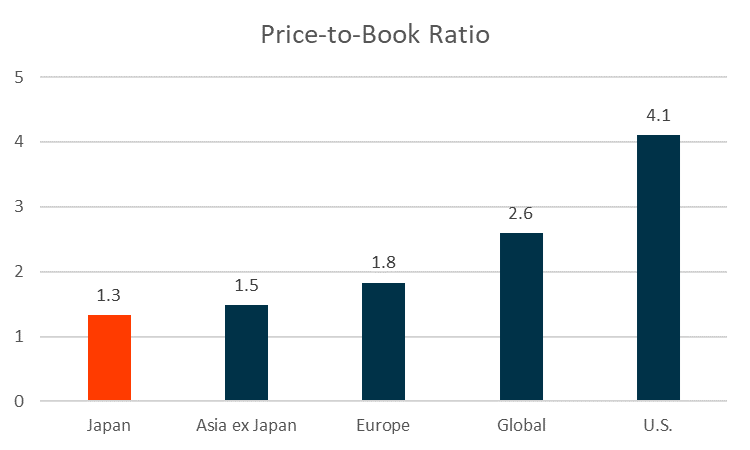

The price-to-book ratio (P/B) of Japanese stocks is 1.3 times, which is lower compared to 4.1 times for the U.S. and 1.8 times for European stocks.

Figure 3 – Japan Price-to-Book Ratio

More than half of the listed companies in the Japanese market trade with a P/B ratio below one2, suggesting many companies could be undervalued. As a result, some investors may consider them as part of their value investment strategies.

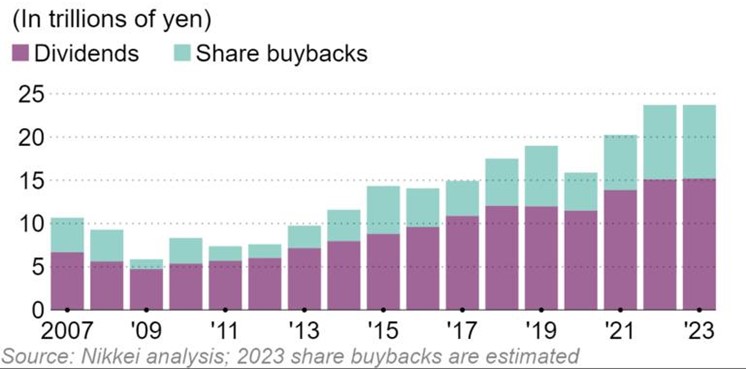

To boost the corporate value of long-term undervalued companies, the Tokyo Stock Exchange (TSE) called on companies earlier this year to demonstrate a better use of capital and concentrate on better corporate governance. In the first quarter of 2023, the amount declared by companies for stock buybacks reached 3.7 trillion yen, surpassing the average amount of the past 10 years3. The corporate dividends also show a stable upward trend during 2021-2023. The government push has led companies to be more open to ideas to boost revenue and stock prices.

Figure 4 – Upward trend of Japanese corporate dividends and share buybacks from 2021-20234

With the ongoing improvement of corporate governance, the market expected that can potentially contribute to sustaining its recent strength for the Japanese stock market.

3. A weak Yen rate favors export and consumption

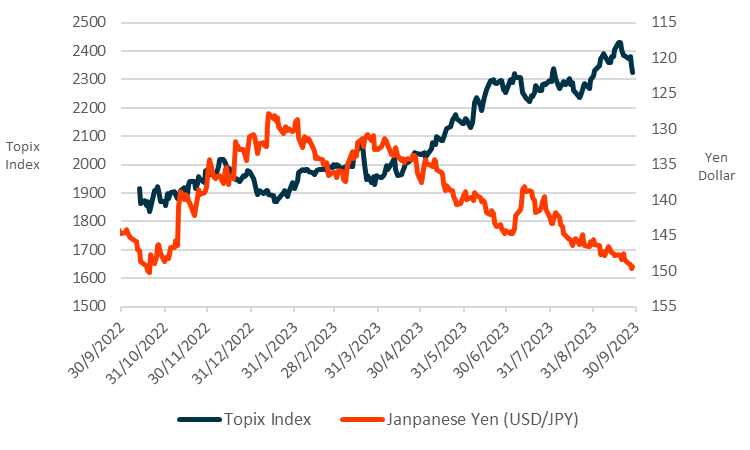

Given the inverse relationship between yen and Japan’s stock market, the weakening yen is considered a significant driver behind the performance of Japanese stocks. Japan’s GDP grew at an annualized pace of 6% in the second quarter of this year, significantly exceeding market expectations of 2.9%5.

Figure 5 – Inverse relationship between Yen Rate and Japan Stock Market

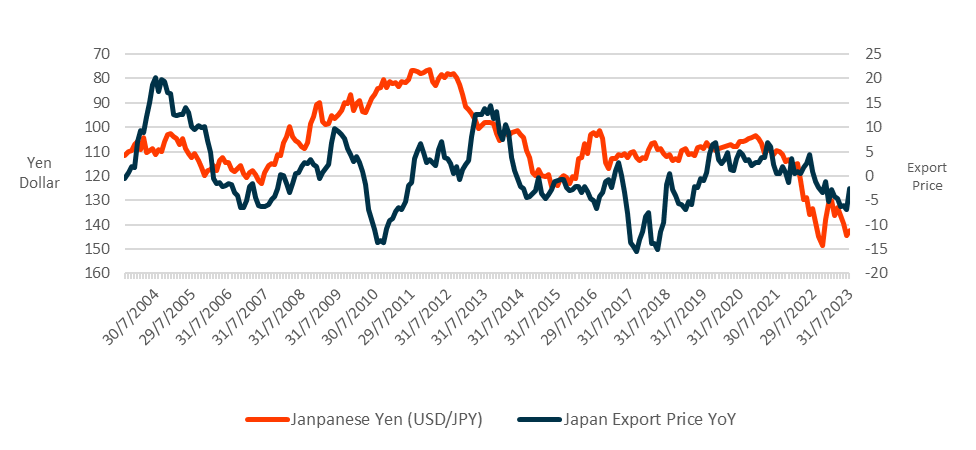

Japanese companies have experienced sustained high-speed growth in profits over the past decade, even outperforming those in Europe and the United States.6 The depreciation of the yen not only helps Japanese companies increase their overseas earnings through foreign exchange, but it also provides a competitive advantage in terms of pricing for exported goods.

Figure 6 – Weak Yen Rate Favors Japan’s Export

The weak yen also boosts tourism by attracting more visitors to Japan. Prior to the pandemic, Chinese visitors accounted for over one-third of tourist spending in Japan.7 With China lifting its ban on group travel to Japan, Chinese visitors are expected to rapidly increase and further stimulate local consumption.

In conclusion, Japan’s sustainable corporate governance and the depreciation of the yen could contribute to boosting market sentiment for medium to long-term investment. Japanese equity funds may offer a favored option for investors seeking to hedge geopolitical risk and capitalize on its low-interest rate environment.

If you would like to understand this asset class and explore potential investment opportunities to diversify your portfolio, please talk to your financial advisor at OnePlatform Asset Management today.

[1] Data from Nikkei Asia; [2] Data from The Japanese Times; [3] Data from MoneyDJ; [4] Data from Nikkei Asia; [5] Data from The Wall Street Journal; [6] Data from Yahoo News; [7] Data from BBC News

#Disclaimer and Notes

Investment involves risk. Investors should carefully consider whether any investment products or services mentioned herein are appropriate for investors in view of their investment experience, objectives, financial resources and circumstances. The information is for general information and reference only and does not constitute nor is it intended to be construed as any professional advice, offer, solicitation or recommendation to deal in any of the securities or investments. OnePlatform Asset Management Limited shall not be liable for any loss or damage caused by any person’s use or misuse of any information or content, or reliance on it. Please consider to seek professional advice before making any investment decision if needed.

Fund products and portfolio management services are distributed and/or rendered by OnePlatform Asset Management Limited (a licensed corporation with SFC CE No. AFQ784).

You May Be Interested In

OnePlatform Asset Management | 06 May 2024

Exploring the Potential of U.S. Equity Funds: Analyzing Factors Driving the U.S. Stock Market

OnePlatform Asset Management | 05 Mar 2024

Exploring the Beenfits of Investment-Grade Bond Funds in the Current Market Environment